Bitcoin began the week in the red, and the rest of the crypto market soon followed. BTC and Ethereum are among the most resilient cryptocurrencies in the top ten by market cap for the weekly chart. Altcoins price highs in Midcap from BTC and ETH.

In the midst of the storm that is affecting Bitcoin and other major cryptocurrencies, a select group has managed to stay in the green. According to a recent report by Arcane Research, the assets that comprised their middle-cap altcoins index profited as the bearish trend progressed.

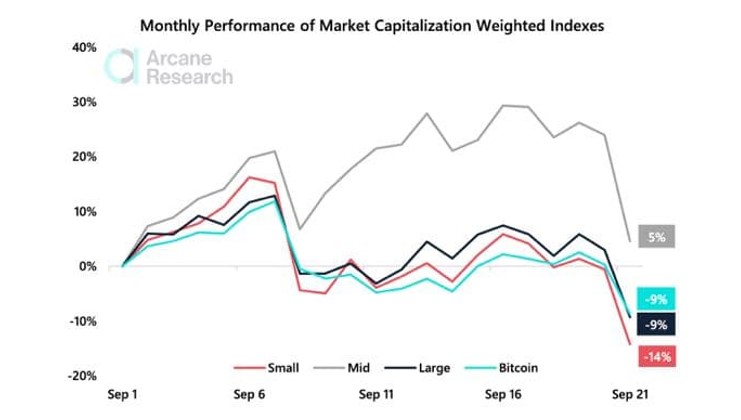

The Mid Cap Index, which includes cryptocurrencies such as Tezos, Algorand, and Avalanche, showed small profits on the 30-day chart. These tokens saw a massive rally during Q3, 2021, and were among the biggest losers during this week’s bearish trend; but they are still up 5% on a monthly basis, as shown below.

In contrast; Bitcoin has lost 9% in the last 30 days; with similar losses for Ethereum, Cardano, Solana, Binance Coin, and other major cryptocurrencies. Smaller assets suffered the greatest losses during this time period, with a 14 percent loss by September 21. According to Arcane Research:

As often happens during market turmoil; Bitcoin dominance increases, as altcoins often act as a high beta play on the crypto sector. The last week; bitcoin’s market share increased by 1.14% grabbing market share from the other big coins like ETH, ADA, and SOL.

Bitcoin Reacts To Macro Factors, What’s Next?

QCP Capital, an investment firm, examined the bigger picture for Bitcoin and the crypto market in a separate report. Despite their fundamentals; mid-caps will most likely follow BTC’s price trajectory in the short term; despite retaining some of their gains in higher timeframes.

The first cryptocurrency by marketcap faces September; a historically bearish month for the asset, as well as potential complications from regulators in the United States and; the performance of Asian markets due to Evergrande.

According to QCP Capital, tomorrow, September 22, will be critical in determining the trend in the short term. When the market reopens after a long weekend; Bitcoin must hold the $40,200 support level in case of further downside pressure.

The firm anticipates that the government will intervene to save the real estate company. Altcoins price highs in Midcap from BTC and ETH . This could be the best-case scenario for Bitcoin and the crypto market, but China’s approach is fraught with fear and uncertainty. According to QCP Capital:

(…) the lack of guidance so far from Chinese regulators is scaring the market. The fear here is that President Xi could allow. Evergrande to fail as an example; to the other real estate players ahead of the 100th anniversary of the Chinese Communist Party (CCP) in 2022. He has already taken draconian steps with Big Tech and Education. At this point, the market has already priced in Evergrande’s equity as worthless (…).

Source: NEWSBTC