Dear Crypto Investor, We recognize that you might be a little unsure about how taxation and TDS would affect your cryptocurrency holdings as of July 1st, 2022 around the corner. Don’t worry we have covered all the bases and made an easy summary for our users.

1% TDS on Cryptocurrency Transactions in India

According to new government guidelines, investors of crypto assets must pay 1% TDS on their transactions from July 1st, 2022. Through the passage of the Finance Act 2022, Section 194S was added to the Income Tax Act. According to the new section, the selling or transfer of a virtual digital asset (VDA) must deduct income tax on that money in an amount equivalent to 1% of the payment which comes under TDS.

What is Section 194S for VDAs in India?

The Finance Bill 2022 has proposed a new section 194S that will take effect on 1 July 2022 and mandate the deduction of tax at source @ 1% on the payment of purchase consideration to a resident person on transfers of virtual digital assets.

Note:

No tax shall be deducted under this provision in the following circumstance:

• If the consideration is payable by any person (other than a specified person) and its aggregate value does not exceed Rs. 10,000 during the financial year.

• if the consideration is payable by a specified person and its aggregate value does not exceed Rs. 50,000 during the financial year.

For More Details – Click Here

BuyUcoin prioritizes compliance and standards issued by the Finance Ministry and RBI in order to safeguard the investment of users.

All the TDS liabilities are on the exchange and not on the users as per government guidelines. So, BuyUcoin will be deducting the 1% TDS on every transaction from July 1st, 2022 onwards. Complete and updated Terms & Conditions will be sent and conveyed to all users in due course; in the meanwhile, please refer to the pointers listed below.

Important Document to Understand TDS on Crypto in India

- What is Section 206AB – Click Here to Learn

- How and When Higher TDS is Applicable – Click Here to Learn

- How to Claim Yout TDS Refund – Click Here to Learn

Trading on BuyUcoin

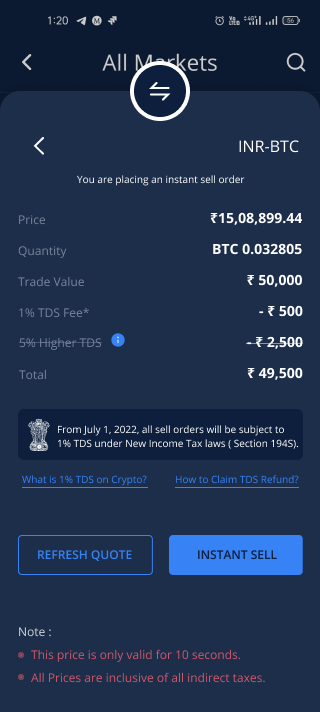

BuyUcoin Web & App has incorporated the guidelines provided by the government. We have added the TDS applicability as per Income Tax Department that you can see on the selling of crypto assets ( Check the image ). So we request our valuable crypto investors to plan your investment accordingly.

*Please note that trading may continue to be disabled for a few coins even after the changes due to certain TDS-related implications. We apologize for the inconvenience.

Some Key Points to Consider for TDS on Crypto:

- Trading will be available in both Classic and EZ markets.

- Crypto-to-crypto trade has been suspended until compliance is changed.

- The BUC Fees Offer has also been put on hold pending compliance changes.

Applicability of Higher TDS ( Upto 5% ) on Crypto:

TDS will be levied on the user’s applicability under section 206AB (Click here to read the detailed explanation of section 206AB). As there is no way to determine the net revenue of individual & corporate users so, TDS will be deducted on every transaction made on the exchange.

As most of the crypto investors fall under the 1% TDS bracket, A small portion of us will also be required to pay a higher 5% TDS. As Section 206AB states if the underlying conditions are not met, Exchange is liable to deduct higher TDS up to 5% as per government guidelines –

- The person does not file the income tax return for the financial year (before Budget 2022, two FY) immediately preceding the FY in which tax is required to be deducted,

- where the income tax return (not belated return) filing due date is expired and

- The total amount of deduction and collection of tax (TDS and TCS) is Rs.50,000 or more in each of these two previous years.

Points to Consider for Higher TDS on Crypto in India

- The provisions of Section 206AB will not apply in cases where the amount does not exceed

a. For Business ( sales, gross receipts or turnover ) – INR 1 Crore

b. For Individual ( salary on service ) – INR 50 lakh,

in the previous financial year with respect to the current year in which such VDAs were transferred or sold. - At the end of the financial year, while filing ITR if you have TDS receivables and your calculated tax is coming out less than your receivable TDS then you can file for TDS returns and government is liable to pay. BuyUcoin will also provide a TDS certificate every quarter on your transactions to ease the process.

FAQs on Crypto TDS in India

What is TDS and when is it applicable?

Tax Deducted at Source(TDS) is an advance tax collected at the source through the authorities to set up a path of transactions.

Under this system, tax is deducted at the origin of the income. Tax is deducted through the payer and is mandated to the tax government by the payer on behalf of the payee.

As in step with revised Income Tax regulations, all sell transactions of crypto assets will be subject to 1% TDS (Tax Deducted at Source) from July 1, 2022.If I pay 1% TDS, should I also pay the 30% tax on crypto assets?

Under income tax regulations, 30% tax is applied to Crypto profits. But this tax, together with the overall income tax payable based on your other sources of income, may be adjusted to deduct TDS by us.

What is the 1% TDS and where will it be applicable?

As per revised Income Tax regulations, the 1% TDS will be implemented with impact from July 01, 2022, on “Payment on transfer of Virtual Digital Asset”

Here’s the govt. official link to the Income Tax Website. See the Section 194S, which mentions the taxation guidelines on Virtual Digital Assets: https://www.incometaxindia.gov.in/_layouts/15/dit/mobile/viewer.aspx?path=https://www.incometaxindia.gov.in/charts%20%20tables/tds%20rates.htm&k=&IsDlg=0

Where is 1% TDS applicable?

Buy Order – No TDS is applicable (If buy any crypto with INR Pair, then TDS is not applicable)

Sell Order – 1% TDS is applicable (If sell any crypto with INR Pair then 1% TDS is applicable)Is TDS applicable on all transactions (Buying, Selling, Deposit & Withdrawal)?

TDS is applied most effectively to the sell or transfer of crypto assets. No TDS will be applicable on buying crypto or holding your crypto.

Will I get any TDS reports?

BuyUcoin will provide users an invoice with a break-up of the amount deducted, such as TDS and fees, for every order.

Further, BuyUcoin will offer customers TDS certificates (Form 16A) for each quarter. The certificates will include the information of the TDS deducted via BuyUcoin for the quarter that can be used to claim TDS refund.How TDS will be calculated in the classic market?

1% TDS to be deducted from the overall transaction value. Let’s say if the sell order price is INR 1500, we will deduct (1 percent of 1500) as TDS from the user and the user gets (1500-x % of 1500 – fees) in his account. So, we will deduct 1% of 1500 i.e. INR 15 as TDS and the fee rate is 0.24%, another deduction of 0.24% of 1500 i.e. INR 3.6 as fees, so the user gets back (1500 -15 – 3.6) = INR 1481.4 in his/her account.

Who will be liable to deduct 1% TDS?

The exchange shall deduct the 1% TDS primarily based on order types as per government rules.

Is the 1% TDS mandatory?

Yes, as in line with revised Income Tax regulations, TDS is compulsory to be deducted on all relevant orders. However, TDS can be adjusted or claimed as a reimbursement while submitting ITR for the financial year.

Should I deposit TDS with the tax authorities?

BuyUcoin will remit any amount collected as TDS at the time of trade execution with the tax authorities on behalf of the user. TDS details for numerous sources of income can be viewed on your Form 26AS return. This amount can be adjusted against your gross tax liability at the time you file your income tax return.